The Harmonized System code (or HS code) is the silent gatekeeper of global trade. It only takes one wrong digit, and your best-selling product might end up stuck at customs or incur added import duties.

Data from the World Customs Organization says over 98% of international trade products are classified through the HS code.

What is an HS code?

A Harmonized System (HS) code, is a globally recognized numerical system used to classify products in international trade. Think of it as a universal product ID that customs authorities around the world understand—kind of like a passport for your products.

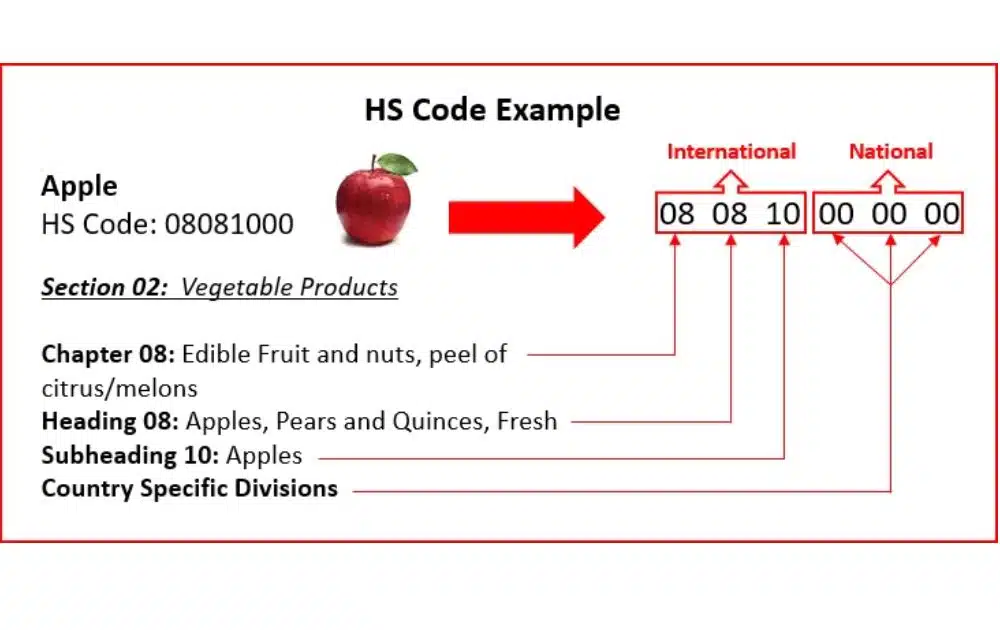

Let’s say you’re shipping apples overseas. You might see a code like 08081000 listed on the paperwork. That “random” set of numbers tells customs exactly what’s inside the box:

- Chapter 08: Edible fruit and nuts

- Heading 08: Apples, pears, and quinces, fresh

- Subheading 10: Apples

- The additional digits vary by country, and are used to specify tariffs and monitor trade more precisely.

These codes aren’t just for agriculture—they apply to everything from electronics to skincare to home decor. If you’ve ever noticed numbers linked to GS1 barcodes on retail packaging, they often tie back to the same classification principles used in HS coding.

For Amazon sellers managing international shipping, using the correct code ensures your product clears customs quickly, gets taxed properly, and avoids delays or penalties. Misclassifying your item—even by accident—can result in fines, returns, or weeks-long holdups at the border.

Here’s another common related question – what is an HS tariff code? An HS code and an HS tariff code are essentially the same thing—but used in slightly different contexts.

The term HS tariff code refers to the same HS code but emphasizes its use in determining customs duties and tariff classification. That said, it highlights that the code is used for import and export tax purposes.

HTS code vs HS code

If you’ve been scanning your shipping labels or filling out shipping documentation, you’ve probably come across both the HS code and the HTS code.

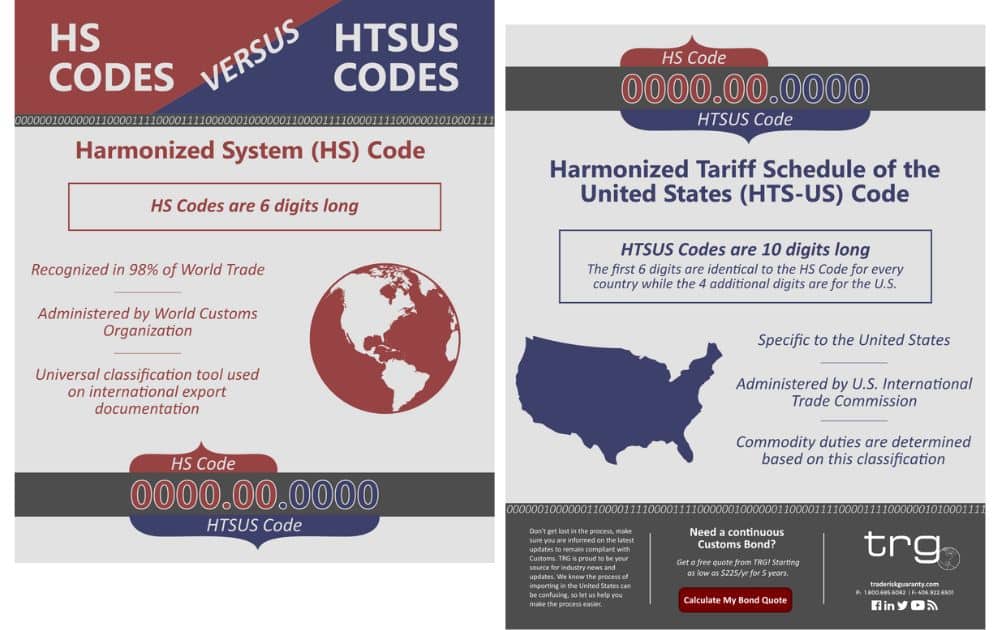

HTS stands for the Harmonized Tariff Schedule. While the HS code is developed by the World Customs Organization (WCO) and is used by more than 200 countries, the HTS code is the U.S.-specific extension of the HS code. It’s also called HTSUS code, which stands for the Harmonized Tariff Schedule of the United States.

It takes the global 6-digit base and adds four extra digits (making it 10 digits total) to provide a more detailed classification for imports into the United States. These extra digits help U.S. Customs and Border Protection (CBP) determine import duties more precisely.

For example:

- HS Code: 080810 — Apples

- HTS Code: 0808100010 — Fresh apples of a specific variety

So, which one should you use?

- Use HS when filling out international shipping documentation or exporting goods from the U.S.

- Use HTS when importing products into the U.S. or calculating import duties.

Why HS Codes Matter for Amazon Sellers

If you’re an Amazon seller with your sights set on selling overseas, it’s essential to be familiar with your product’s HS code. Here are a few reasons why:

Your Products’ Passport

Every country relies on HS codes to identify products and apply the correct tariff classification. If you’re selling overseas, an accurate code ensures that customs officials in the destination country know exactly what you’re shipping—reducing the risk of delays, inspections, or surprise rejections.

International Payments and Taxes

The HS code you use also determines how much import tax or customs duty your buyer pays. That means it directly impacts the total cost of your product for international customers.

Misclassify your item, and they might be charged more than expected—or worse, the shipment gets held up and returned.

For sellers working with international payments and taxes, consistency in product classification is key to staying compliant, avoiding fines, and preserving profit margins.

Smooth FBA Deliveries

If you’re using Amazon FBA, your shipping labels and customs documentation must include the correct HS code. This ensures fewer returns at borders and more reliable delivery timelines—factors that ultimately affect your seller ratings.

How to Find the Correct HS Code

While some suppliers or manufacturers do provide the HS code for a product, it’s not always guaranteed—and even when they do, it’s still the seller’s responsibility to make sure it’s correct.

Here are tools and strategies to make your HS code search easier:

Use Official Government Tools

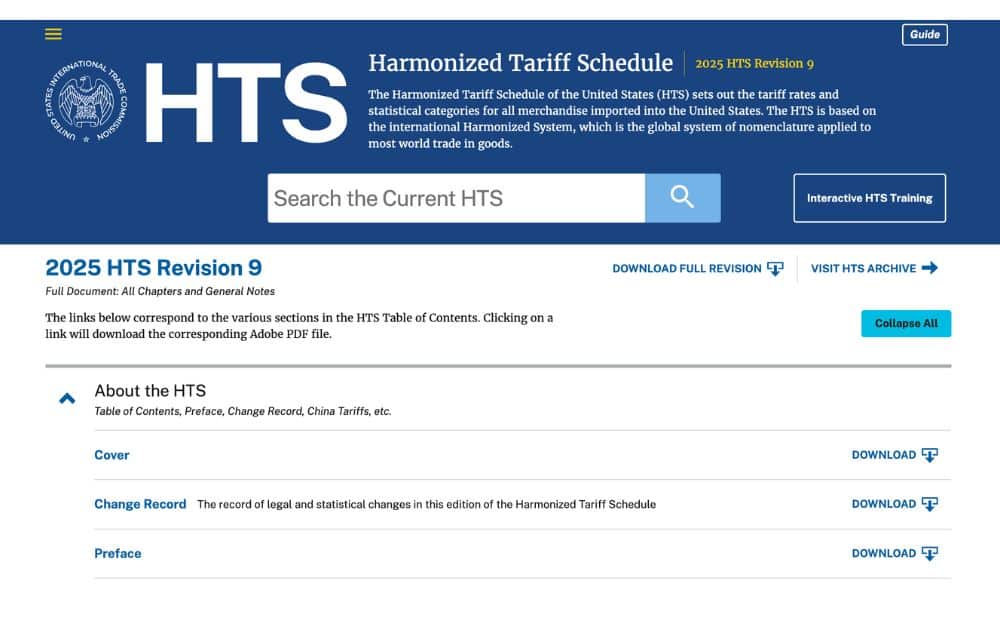

When looking for or verifying the HS code of your product, start with trusted sources like:

- HTS Search – Ideal for U.S. importers. You can type in a product name and browse matching codes.

- FTA Tariff Tool – Useful for U.S. exporters shipping to countries with free trade agreements. If you already know your HS code, this tool helps check tariff rates and eligibility under trade deals.

Check with Logistics Partners

Shipping providers like DHL and Maersk have online guides that explain HS codes and often include examples for common products. These are especially useful if you’re new to international shipping.

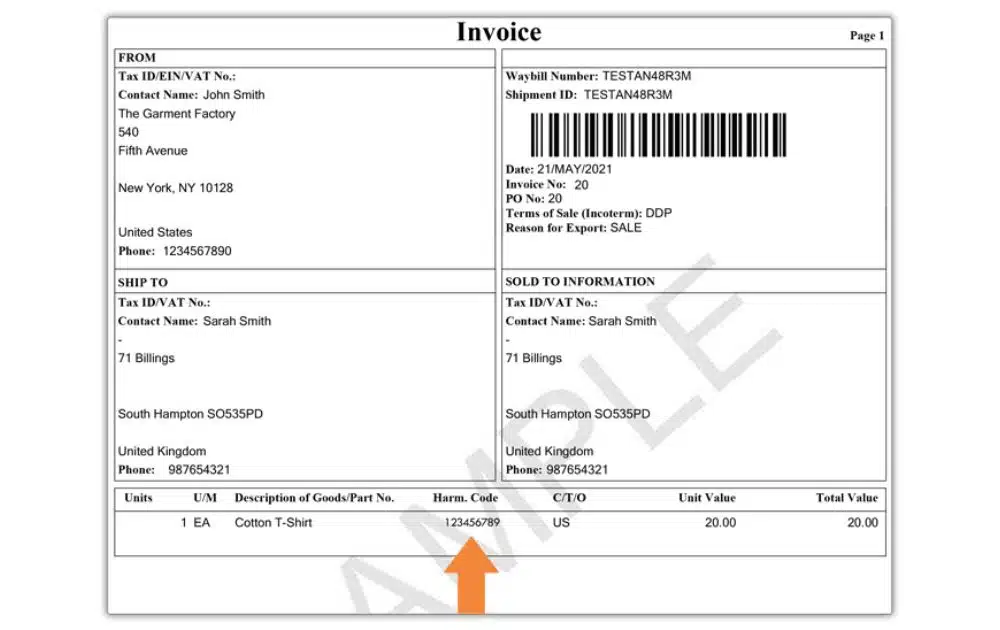

Look at Supplier Invoices or Product Sheets

If you’re reselling goods, your supplier might already include the HS code on:

- Commercial invoices

- Packing lists

- Product specification sheets

Just make sure the code applies to your country’s import/export system.

Consult a Customs Broker

If your product is complex, like multi-material goods or kits, it’s worth consulting a licensed customs broker. They can help ensure the code aligns with the correct tariff classification for the destination country.

- Pro Tip. Don’t want to navigate the red tape alone? AMZ Advisers can help you streamline compliance and optimize your listings for international markets. Their team specializes in Amazon growth strategies, so you can focus on scaling while they handle the cross-border details.

Common Mistakes to Avoid

Let’s break down the most common pitfalls related to HS codes—and how to avoid them.

Using the Wrong Code

Many sellers assume they can just pick any code that sort of fits their product—or worse, copy a code used by a competitor without checking if it’s an exact match.

For example, a seller may list a bamboo kitchen utensil set under a code meant for plastic utensils because they look similar. At customs, the shipment might be held due to a material mismatch, delaying delivery and incurring reclassification fees.

- Best Practice. Base your classification on the product’s main material and function. Use official tools like HTS Search or consult a customs broker to ensure you’re using the most accurate code.

Skipping Verification from Suppliers

Relying 100% on the HS code provided by your supplier without verifying if it applies to your importing country can cause issues down the road.

For instance, a supplier in China uses a general HS code for leather bags, but the U.S. requires a more specific HTS code based on whether the leather is bovine or synthetic. Using the wrong code can lead to a higher duty rate and a flagged shipment.

- Best Practice. Treat the supplier’s code as a starting point, not a final answer. Always verify the code using a country-specific resource, like the U.S. HTS database, especially if you’re importing into the U.S.

Leaving the HS Code Out of Shipping Documentation

Some sellers forget to include the HS code on key documents like the commercial invoice, packing list, or shipping labels. Doing so can cause confusion and shipping delays.

For example, an Amazon FBA seller sends a batch of electronics to a fulfillment center in Germany but leaves the code field blank. Customs officers can’t process the shipment without the proper classification, causing it to be held for inspection.

- Best Practice. Make sure the correct code appears on all shipping documentation. Include it next to the product description on invoices and customs forms to avoid clearance delays.

Not Updating the HS Code After Product Changes

Don’t assume that the HS code stays the same even after modifying your product or bundling it with other items.

For example, you originally sold individual yoga mats but later started bundling them with carrying straps. The product’s function changes slightly, and the original code no longer fully applies. Customs will classify the product differently and your shipment will be delayed.

- Best Practice. Whenever you introduce a new version or bundle, revisit your HS classification. If the item’s material, use, or composition changes, the code might need to change too.

The Lowdown

Getting the HS code right might feel like a small detail, but for Amazon sellers working with international shipping, it can make or break your delivery experience.

Always double-check your code—especially if your product changes or bundles evolve. A properly classified product speeds up customs clearance, ensures accurate tariff classification, and keeps your buyers happy by avoiding delays or surprise charges.

Author

Carla Bauto Deña is a journalist and content writer producing stories for traditional and digital media. She believes in empowering small businesses with the help of innovative solutions, such as e-commerce and digital marketing.

Carla Bauto Deña is a journalist and content writer producing stories for traditional and digital media. She believes in empowering small businesses with the help of innovative solutions, such as e-commerce and digital marketing.