If you’re looking for funding options for Amazon sellers in order to fuel your business, you’re not alone.

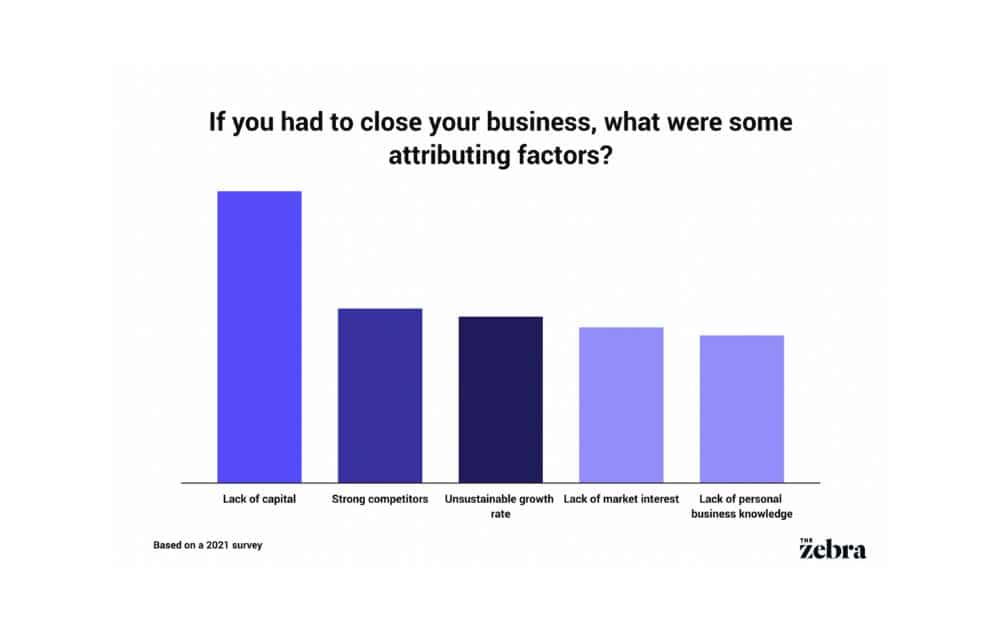

Financing remains one of the most crucial challenges of building a sustainable business. In fact, 2021 data says more than one-third of small business owners identified “lack of capital” as a top reason why the venture had to close.

For many Amazon sellers, the quest to find funding options can seem as challenging as discovering a hidden gem in the vast Amazonian jungle. The landscape is dense and complex, with a variety of paths to explore and decisions to make.

But it takes more than just looking at numbers. You also need to delve into the strategic implications of acquiring funding. So, grab your financial map as we uncover the treasures that lie beneath the surface of loans, lines of credit, and seller-specific funding solutions.

Amazon Lending

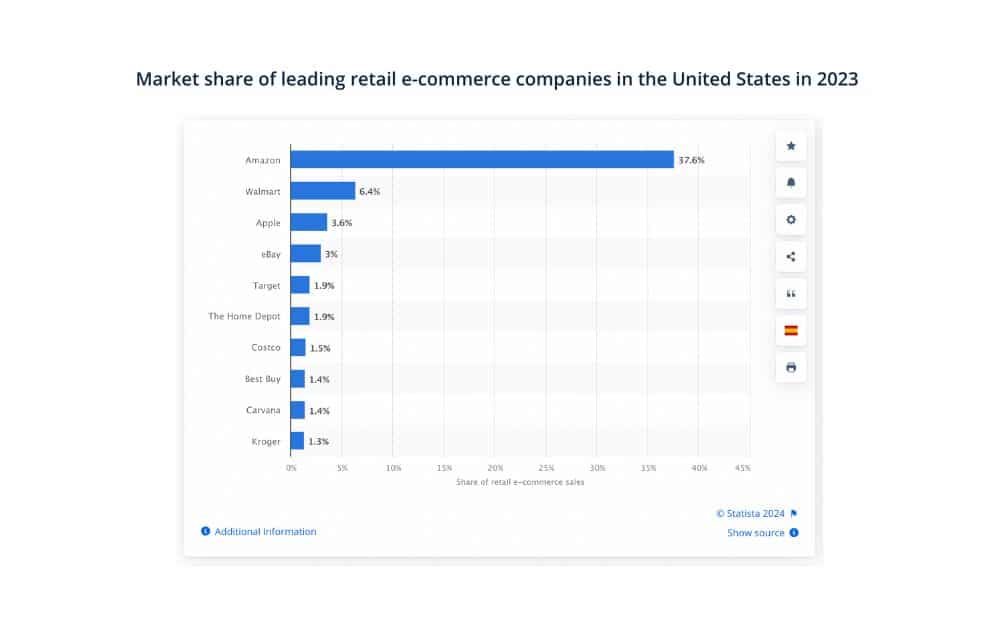

Amazon secured its position as the leading online retailer in the US in 2023, holding a dominant 37.6% share of the market. Walmart’s online platform trailed behind in second place, accounting for 6.4% of the market, while Apple ranked third, capturing 3.6%.

This dominant position enables Amazon to offer various funding options to its sellers, helping them grow and succeed in a highly competitive landscape.

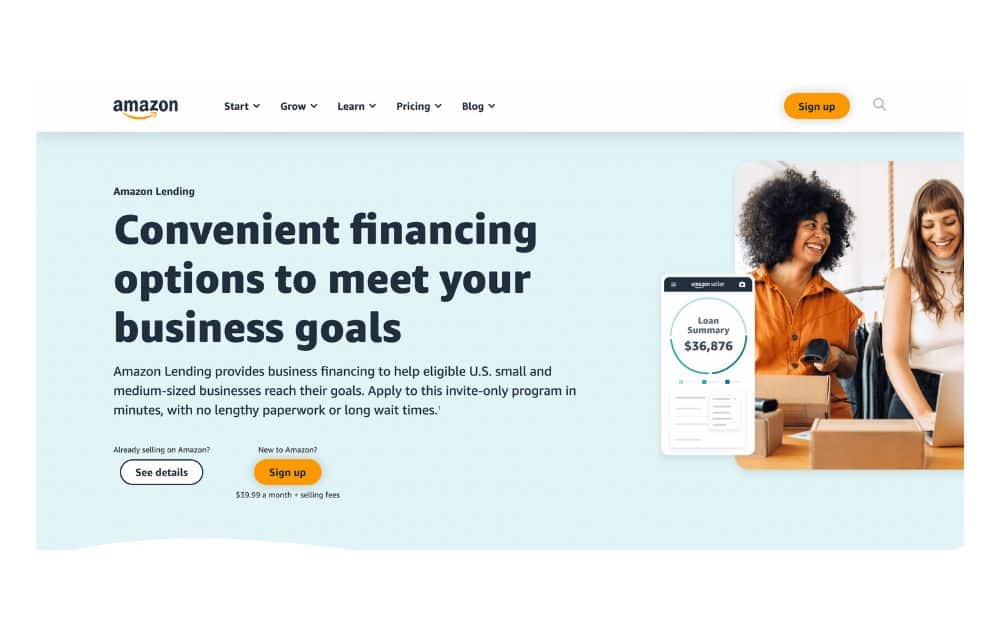

To sustain its dynamic marketplace, Amazon provides several funding options, each designed to bolster their growth and success on the platform- One of the most direct paths for funding is Amazon Lending, a program designed specifically for eligible sellers on the platform.

Amazon seller lending offers loans to purchase inventory, expand product lines, or invest in marketing. The key here is eligibility; not all sellers qualify.

Here are some of the available funding options for Amazon sellers under the program:

Term Loan

Term Loan is a non-revolving, lump-sum funding option with a specified payback period. It requires equal monthly principal and interest repayments. It’s best for sellers planning for long-term growth and continuous expansion.

Providers

- Amazon Lending. Known for its convenient application process directly through Seller Central, eliminating lengthy paperwork.

- Lendistry (Amazon Community Lending). A partnership with Lendistry, a minority-led Community Development Financial Institution (CDFI), focusing on small businesses in socially and economically distressed communities.

- Interest Rate. Fixed.

Merchant Cash Advance (MCA)

This program provides an advance on future earnings, giving sellers immediate access to capital. A flexible option, this Amazon loan for sellers is especially beneficial for ventures experiencing rapid growth or seasonal sales fluctuations.

Providers

- Parafin. Focused on growing small businesses―especially those impacted during the pandemic―Parafin offers a merchant cash advance to Amazon sellers, emphasizing fast, easy access to capital.

- Interest Rate. No interest; sellers pay a fixed capital fee.

Business Line of Credit (LoC)

This is one of the funding options for Amazon sellers with more substantial financial needs. Amazon’s LoC for businesses is often larger than typical FBA loans, and it provides ongoing access to funds, up to a certain credit limit.

The Amazon business line of credit requirements involve a review of your financial health and Amazon sales history. Understanding the application process is crucial, as it often involves detailed financial disclosures and a strong credit history.

Providers

- Marcus by Goldman Sachs. In collaboration with Amazon Lending, they offer competitively priced financing products, combining over 150 years of financial experience with innovative technology.

- SellersFi. A global fintech company providing strategic, affordable, and flexible funding options as part of its collaboration with Amazon Lending.

- Interest Rate. Fixed rate on the drawn balance, ensuring sellers only pay for the funds they use.

Outside Financing for Amazon Sellers

While Amazon provides a range of funding options for sellers, business owners may also choose to avail of external funding sources. These alternatives can complement or serve as substitutes for financing for Amazon sellers offered directly through the platform.

Small Business Administration Microloan

The U.S. Small Business Administration (SBA) Microloan program offers small loans to entrepreneurs, including Amazon sellers. These loans are typically administered by nonprofit community-based organizations and can be used for various business purposes.

The average microloan is around $13,000, but the program can provide loans up to $50,000. This program is best for sellers seeking lower loan amounts with manageable repayment terms.

- Interest Rate. Typically from 8% to 13%, varying based on the intermediary lender and the specifics of the loan.

Peer-to-Peer Business Loan

You may also want to check out Peer-to-Peer Business Loans when looking for external Amazon business loans. P2P platforms connect borrowers with individual lenders, bypassing traditional banking structures. This can lead to more accessible and quicker funding.

This option can be best for sellers who may not meet traditional loan criteria or need faster funding. As an Amazon seller loan option, P2P loans offer flexibility and competitive rates, though they can be higher for riskier credit profiles.

- Interest Rates. Interest rates can vary widely, usually between 6% and 36%, depending on creditworthiness and the platform used.

Personal Loan

Personal loans, based on individual credit scores, can be used for business purposes and are a typical avenue when business credit history is limited.

This can be one of the best funding options for Amazon sellers who are new to business, or those without an established business credit history.

- Interest Rates. Personal loan rates typically range from 6% to 36%, influenced by credit history and loan terms.

Tips for Amazon Seller Funding

Here are a few tips to help you make the most of the funding options for Amazon sellers:

Understand Your Amazon Reports

Regularly review your Amazon reports to understand your sales trends and inventory needs. This will help you make informed decisions about when and how much funding to seek.

- Actionable Tip. Schedule a monthly review of your Amazon sales and inventory reports to stay on top of your business health.

Explore All Funding Options

Don’t limit yourself to one type of funding. Explore various funding options for Amazon sellers, including Amazon loans, lines of credit, and external financing.

- Actionable Tip. Make a list of potential funding sources and compare their terms and conditions to find the best fit for your business.

Understand the Terms of Loans for Amazon Sellers

Loans can be a powerful tool to grow your business, but they come with obligations that can impact your financial health if mismanaged.

For instance, Some loans may have additional fees, like origination fees, processing fees, or penalties for late payments or early repayment. These can add up and affect the overall cost of borrowing.

- Actionable Tip. Read the fine print and possibly consult with a financial advisor to understand the implications of the loan.

Manage Sales Tax Collection Efficiently

Managing sales tax collection is a critical aspect of financial management for Amazon sellers, and it has a direct impact on their financing needs and overall profitability.

Non-compliance can lead to penalties and interest charges, which can strain your financial resources and negatively impact your creditworthiness.

- Actionable Tip. Use automated tools or consult with a tax expert to manage your sales tax collection effectively.

Stay Informed About Sales Tax Nexus

Understanding sales tax nexus laws in different states helps in accurate financial planning. It affects your pricing strategy, cash flow management, and overall profitability. These factors are crucial when considering funding options for Amazon sellers.

- Actionable Tip. Regularly review nexus laws in states where you operate to ensure compliance and factor these costs into your funding needs.

Maintain a Strong Credit Score

A high credit score builds confidence in lenders. It indicates that you have a history of managing your debts responsibly and are likely to repay any new loans.

This is particularly important for Amazon sellers seeking external funding. A strong credit score can open up a wider range of financing options with better terms.

- Actionable Tip. Regularly check your credit score and take steps to improve it, such as paying bills on time and reducing debt.

The Bottom Line

Whether you choose to avail internal or external funding options for Amazon sellers, it all boils down to knowing the pros and cons of each financing avenue.

Take the time to review each option, how it will impact your operations, and if the payment terms can be beneficial to growing your business.

Author