The VAT number, are you familiar with it? Many thriving Amazon sellers in the US typically aim to expand their sales to another lucrative market, such as Amazon in Europe.

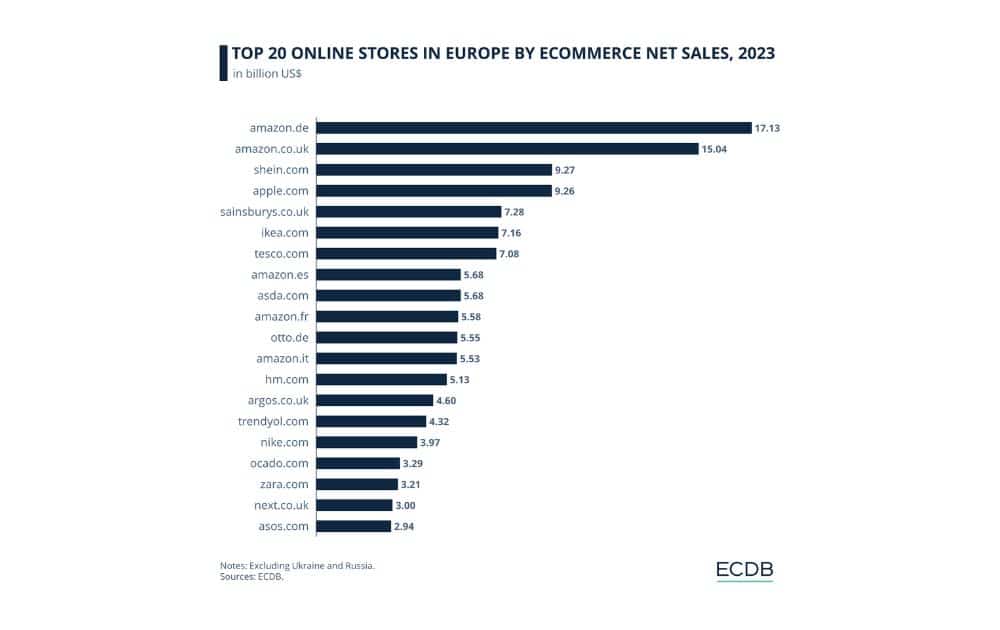

It’s not surprising that so many selle want to penetrate the European market. After all, 2023 data shows five Amazon European marketplaces to be among the top 20 online stores in the continent, particularly Amazon Germany, Amazon UK, Amazon Spain, Amazon France, and Amazon Italy.

Amid the promise of entering new bustling marketplaces, one factor seems to intimidate sellers from pursuing the opportunity: the European Value Added Tax number and its intricacies.

Let’s discuss the VAT number and how international merchants can get one. We’ll also discuss the rates and compliance rules surrounding VAT, as well as how to pair it up with services like Amazon FBA.

What is a VAT Number?

Let’s begin with a basic question: what is a European VAT number? VAT stands for Value Added Tax, which is a tax imposed on consumer spending. A VAT number is a distinctive identifier that businesses in Europe use to monitor and handle VAT transactions.

In Europe, VAT can be collected on business transactions, as well as goods and imports that move between countries. That said, if you keep stock in Europe, or if you sell goods in any European country, you may be required to apply for an EU VAT number.

Here’s another common question: Do I need a VAT number? As an Amazon seller, VAT obligations depend on several factors, such as:

- The location of your business

- Your chosen fulfillment model

- The business’ annual sales

How Much is VAT in Europe?

Two basic rules apply to VAT guidelines, providing European countries the freedom to set their own rates:

- There’s a standard VAT rate for all services and goods.

- The European country can impose one or two reduced rates, limited only to services or goods listed in the VAT Directive.

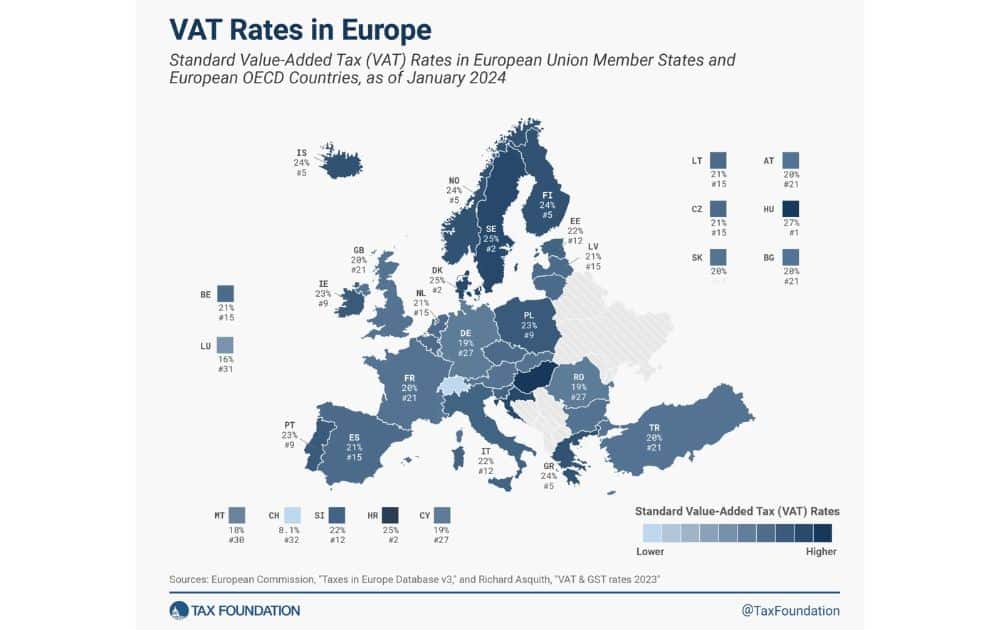

VAT rates in Europe can vary between countries, and may also differ depending on product types. The standard rate is a minimum of 15%, and there is no set maximum rate.

In 2024, Hungary set the highest VAT rate at 27%, followed by Croatia, Denmark, and Sweden at 25%.

Here are the other 2024 VAT rates of countries with an Amazon marketplace:

- France – 20%

- Italy – 22%

- Germany – 19%

- The Netherlands – 21%

- Spain – 21%

- United Kingdom – 20%

Europe VAT Distance Selling Thresholds (July 2021 Onward)

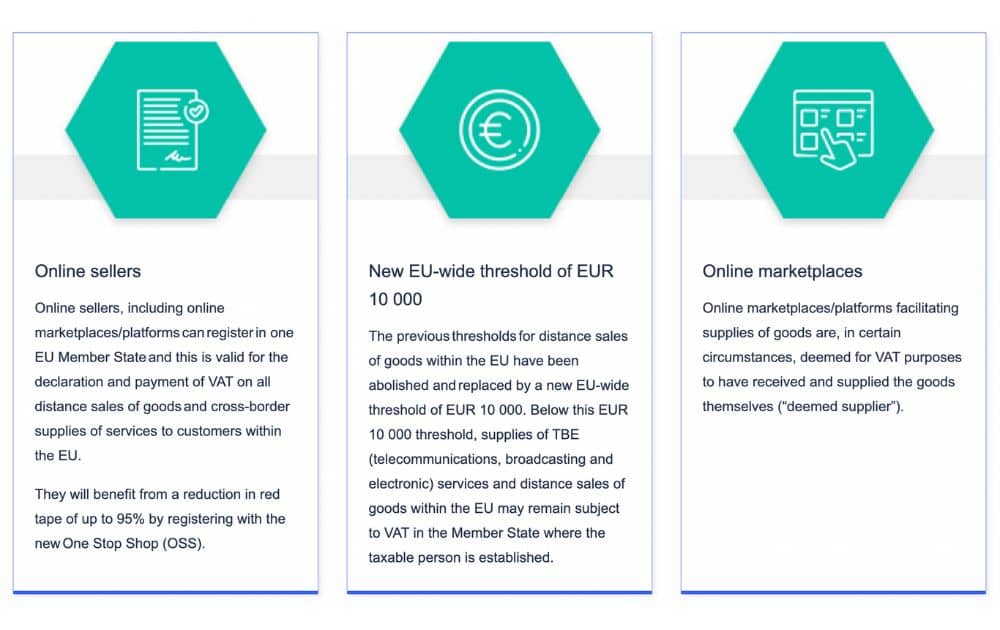

Before July 2021, each EU country had its distance-selling threshold, ranging from €35,000 to €100,000.

Starting in July 2021, however, the EU implemented a unified threshold of €10,000 for total cross-border sales of goods and digital services to consumers within the EU.

This means that if a business’s total distance sales across all EU countries exceed €10,000 in a calendar year, the business must register for VAT in each EU country where it sells goods.

One Stop Shop (OSS) Scheme

To facilitate easier VAT compliance, the One Stop Shop (OSS) scheme has been expanded. Previously, the Mini One Stop Shop (MOSS) scheme only covered digital services, but the OSS now includes distance sales of goods and other services.

The OSS scheme offers the following benefits:

- Single Registration. Businesses can register for VAT in one EU member state and handle all VAT reporting and payments for their EU-wide sales through a single portal. This eliminates the need to register in multiple countries.

- Simplified Reporting. Businesses file quarterly VAT returns via the OSS portal, covering all sales across the EU. The tax authority in the country of registration then distributes the VAT to the respective member states.

- Reduction in Administrative Burden. The OSS significantly reduces the administrative tasks involved in cross-border VAT compliance, allowing businesses to focus more on their core activities.

How to Get a VAT Number

Now that we’ve explored VAT in Europe, let’s discuss how to get an EU VAT number. Here’s a simple step-by-step guide on how you can get a VAT ID number in Europe:

1. Check Thresholds

Verify if your business exceeds the VAT registration thresholds in the country where you plan to operate, with the EU-wide threshold for cross-border sales set at €10,000.

2. Gather Required Documentation

Prepare your business registration documentation, including the following:

- Business registration certificate

- Proof of business address

- Bank details

- Tax Identification Number in your home country

3. Choose a Country for Registration

You may select the country where you primarily conduct business or store inventory. This will be your base for VAT registration. For example, you can apply for a uk vat number if you only wish to do business in the United Kingdom.

Alternatively, you can go the OSS scheme route, which can simplify VAT compliance across multiple EU countries.

4. Submit the Application

Most EU countries offer online portals for VAT registration. Submit your application through the relevant tax authority’s website by filling out the application with detailed information about your business. Make sure that you include financial details and the nature of your operations.

5. Receive Your VAT Number

Once your application is processed, you will receive a unique company VAT number for your business. Processing times can vary by country.

You can also check the validity of a VAT identification number using the European Commission’s VAT Information Exchange System available online.

6. File VAT Returns

For ongoing compliance, you need to file VAT returns. You can do so monthly, quarterly, or annually―or as required by the country of registration.

You also need to maintain records of all transactions, including invoices and receipts, for at least six years.

VAT Services on Amazon

VAT Services on Amazon offers a streamlined solution to handle your VAT registration and filing requirements in a convenient and cost-effective manner. Its services include VAT Registration and VAT Filings.

Availing VAT services on Amazon would allow you to enjoy a simplified VAT compliance process. It will also allow you to manage your VAT obligations directly from your Seller Central account.

Fulfillment by Amazon and VAT Considerations

When using Amazon FBA to expand your business into European markets, it’s essential to understand and manage your VAT obligations effectively.

Here’s how to integrate FBA with VAT considerations, ensuring compliance and optimizing your operations.

Understand Your VAT Obligations

Know the basics of your VAT obligations when storing inventory in Europe. This is crucial because storing goods within an EU member state triggers VAT registration requirements.

Utilize Amazon’s VAT Calculation Services

Amazon’s VAT Calculation Service (VCS) allows sellers to show VAT-exclusive prices to Amazon Business customers and earn the Downloadable VAT Invoice badge.

This badge signifies that VAT invoicing is guaranteed for each shipment, making sellers more appealing to customers who prefer this assurance. Business customers can also restrict, or block offers from sellers lacking the badge.

Sellers enrolled in the VCS program have two invoicing options:

- Allow Amazon to generate invoices on their behalf.

- Upload their own invoices.

Both options ensure sellers receive the Downloadable VAT Invoice badge, display VAT-exclusive prices to customers, and make invoices available for customers to download from their accounts.

You can enroll in VCS right from your Seller Central account. Simply look for the Help section and click the “Enroll in the VAT Calculation Service” page.

Plan your Pricing Strategy Efficiently

Expanding into the European market through Amazon FBA requires a well-thought-out pricing strategy to ensure compliance with VAT regulations while maintaining profitability.

To cover VAT alone, if your product price is €100 and the VAT rate is 20%, the VAT-inclusive price should be €120.

You also have to factor in Amazon Global Selling fees and costs like international shipping fees that may not be applicable when selling in your home country.

In addition, you also need to display VAT-inclusive prices on your product listings to comply with local regulations and build trust with customers.

Monitor Exchange Rates

When selling in Europe, revenues are collected in euros. Still, if your home currency is different, such as US dollars, changes in exchange rates can affect the amount you ultimately receive.

VAT liabilities, meanwhile, are calculated based on the sales price in the local currency. Therefore, any fluctuations in exchange rates can impact the amount of VAT you owe when converting sales revenue back to your home currency.

The Lowdown

Navigating your way through the Europe VAT number can indeed be a big task – from understanding VAT obligations to pricing your products to cover all the extra costs of selling beyond your home country.

But just like an explorer discovering uncharted territories, dedication, research, and the right mindset will allow you to reach new heights.

Author