The retail giant launched Amazon Lending over 10 years ago. And though it still is an invite-only initiative, the past decade is testament to its reliability.

Here’s your dilemma: you want to expand but don’t have the funds to do so. Even though an eCommerce business requires many expenses, this shouldn’t deter prospective entrepreneurs from starting their own company.

If you’re in this situation, you know that business lending is always an option. But with so many types of lending and financial firms to choose from, it can be difficult to find the right loan.

Fortunately, an Amazon seller loan is another solution. Amazon Lending makes it easier for new sellers to gain access to funds so you can grow your ecommerce business. And others are joining the program; in 2022, over 1 million businesses took advantage of Amazon Lending.

Continue reading to discover more about Amazon Seller Lending and if this program suits you.

What Is Amazon Lending?

Amazon Lending is a loan program launched in 2011. Its goal is to help new sellers launch and scale up their businesses.

Sellers can access loans between $1,000 and $750,000; the loan terms are as long as 12 months. You can select your loan amount and term limit when you’re prequalified for a loan.

Unlike many banks and financial institutions, Amazon Lending doesn’t require physical collateral. The program also has a shorter wait time than a traditional loan, and the application process is simple.

You don’t need to go through a credit check for specific loan types; you have different loan options, as we will cover in another section. There’s also no prepayment penalty.

Benefits of Amazon Lending

If you’re looking for financing for Amazon sellers, there are many advantages to this program. Here’s why Amazon Lending may be right for you.

Transparent

When you sign up for Amazon Lending, you can choose your loan amount and know what repayments will be. Amazon includes a loan calculator during the application process, so you’ll never be hit with surprise fees.

Quick Access

You don’t have to wait long to access your funds. Amazon’s application process only takes a few minutes, and you may not even need to undergo a credit check.

The marketplace reviews and approves your application in an average of five days, so you’ll get your funds quickly. However, Amazon may need additional information or documentation to approve your application.

Different Options

Amazon understands that running an eCommerce business requires many expenses. Online sellers must invest in product development, order inventory, pay for storage, and more.

The retail giant offers numerous financing options to ensure you select the best lending option that fits your needs and business goals.

Related content: Amazon Seller Wallet

Different Types of Amazon Loans

While Amazon already offers different lending categories, understand that these loan types come with different requirements. In addition, Amazon is always expanding its lending options and may partner with third parties to deliver the right loan for you.

Business Line of Credit (LoC)

A line of credit is a flexible financing option where sellers can get an Amazon loan for sellers up to a maximum credit amount.

It is the perfect balance between a loan and a credit card; businesses get access to funds immediately, and you only pay interest on the amount you use. The interest is also fixed and locked in for life.

Since businesses receive credit, you can use these funds toward numerous parts of your business. Examples include funding operations and building inventory. Businesses can also use a LoC for any emergency expenses.

There are some key facts to know before signing up for a LoC. Since this loan is credit-based, Amazon must conduct a credit check. The loan is made available by Marcus by Goldman Sachs.

Term Loan

With a term loan, you receive your funds in one lump sum, and the money is non-revolving. You’ll have a payback period where you’ll pay back the principal and fixed interest.

There are two term loans for Amazon sellers: Amazon Term Loans (provided by Amazon) and Amazon Community Lending Term Loans (provided by Lendistry).

With Amazon Term Loans, you can borrow between $1,000 and $1 million. The application process is very simple since Amazon provides this loan–not a third party.

The Amazon Community Lending Term Loan is available to small businesses in economically and socially distressed communities. Businesses can receive between $10,000 and $250,000, with terms lasting up to 10 years.

Merchant Cash Advance (MCA)

Unlike traditional loans, a merchant cash advance is a type of funding where the loan is tied to a portion of the seller’s future sales, called the fixed capital fee.

With an MCA, businesses can gain lending with a flexible payment schedule, no late fees, and no personal collateral. And the best part is there’s no interest.

This is the option for sellers who are still growing and don’t have the funds to repay a loan back every month. Parafin is the provider that offers this loan.

Who Can Leverage Amazon Lending?

Amazon Lending is an invite-only program. Since many loans don’t require collateral or a credit check, Amazon determines eligibility by sales performance.

Certain loan types, such as the Community Lending Term Loan, are only available to sellers based in specific areas. You’ll know if you’re eligible when you receive the invite widget on your Seller Central page.

Understand that choosing Amazon business loans is optional, and you can choose to decline your invitation.

Is Amazon Lending Right for You?

Let’s say you received the Amazon Lending invite. Should you fill out an application? It depends on your business goals.

Amazon Lending is an effective option for sellers who only plan on sticking with the retail giant. Giving sellers a loan keeps stores on their platform and prevents them from going to competitors.

Applying for a traditional business loan may make more sense if you want to use other marketplaces.

Since Amazon locks you in with a loan, you can only use the funds toward your Amazon business. If you host multiple business actions on Amazon, taking out one of their loans makes sense. But if you largely host your business functions on another platform, you’ll be restricted when taking an Amazon loan.

There’s also a reason why Amazon Lending is invite-only. Amazon needs to ensure your business has impressive sales performance so you can make your payments. Amazon Lending isn’t a good option if you’re a new business struggling to maintain sales.

What are some investments that are perfect for an Amazon loan? Common examples include:

- Improving production

- Buying inventory

- Product development

- Bulk buying

- Building business infrastructure

- Advertising and marketing

How to Sign up for Amazon Lending

Before signing up for Amazon Lending, remember a few things. These include:

- Have all forms available during the application process

- Stellar sales performance

- Don’t have any complaints, including copyright or trademark infringement claims

- Offer excellent customer service and maintain positive reviews

All product listings should comply with Amazon’s requirements

To apply for Amazon Lending, follow these steps:

- Log into your Seller Central account

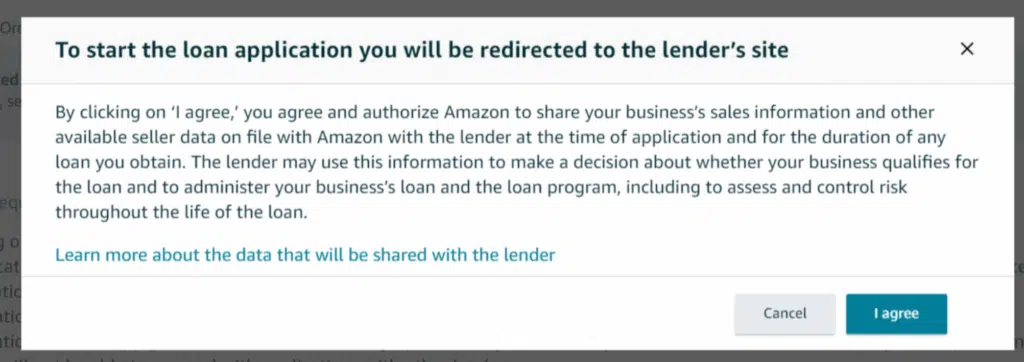

- Find the Amazon Lending invite widget on the home page. Click “Start Application” and approve the terms.

- Choose the type of loan, amount, and term length.

- Fill out the application and send it to Amazon.

- Amazon should review and approve your application within five business days. They will email you if they need additional information.

Amazon may invite you to join their lending program when your business achieves excellent sales performance.

Take Advantage of Amazon Lending

There are many advantages to Amazon Lending, but this program is best for businesses solely selling on Amazon. Amazon Lending eligibility is also strict; you can’t sign up unless you receive an invite.

If you want to grow your business, you also have other options. When you sign up for AMZ Adviser’s services, you can access an expert team to help you reach your full potential on Amazon.

Click here to learn more about our services.

Authors